查找适合您的产品

SEARCH以最简单的方法寻找最适合您的产品

飞马加速器app

PILOT以最简单的方法寻找最适合您的产品

飞马加速器教程(简称“飞马加速器app”)坐落于以山水秀丽、园林典雅著称的“东方水都”苏州潘阳工业园区,由邦得控股集团和扬子新材控股组建,生产与加工基地总6万多方,是一家集科、工、贸为一体的高新技术企业。飞马加速器app以国际一流的金属辊涂印花技术为特色,以绿色低碳多功能涂层金属板的研发、生产、销售一体化生产模式为依托,专注于建筑内外装饰全系统化的研发、生产、应用,不断开拓全新的超低能耗绿色建筑空间,致力于成为绿色低碳多功能涂层金属板应用系统领航者。

飞马加速器app采用产、学、研相结合的创新发展模式,在技术创新、产品研发、特色引领上不断加大投入,拥有一批掌握核心技术、具有高科技研发能力的专家团队。自主研发与科研院校的完美结合,解决了绿色低碳多功能涂层金属板的技术难题。

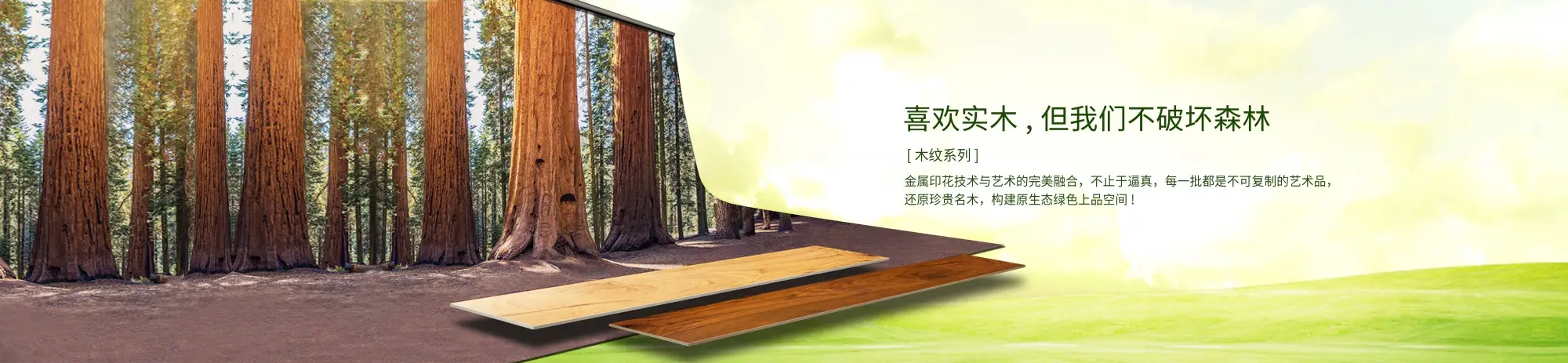

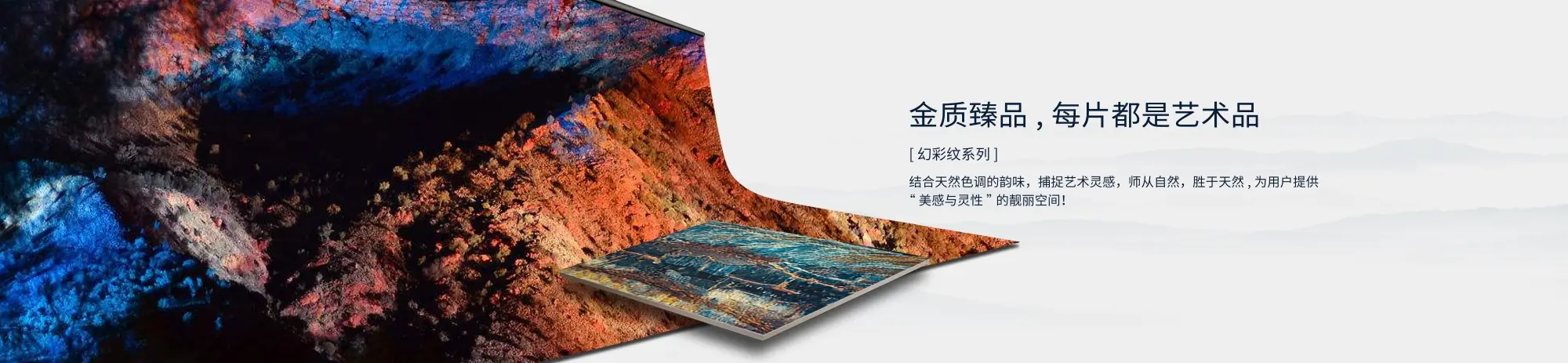

飞马加速器app进口整套世界领先的四套色印花生产设备及核心技术,公司生产的绿色低碳多功能涂层金属板具有色彩绚丽、立体感强、强度高、不褪色、防火抗菌、易安装等特点,应用范围覆盖海陆空全领域,可广泛应用于金融、医疗、城市交通、建筑装饰、邮轮、军工等多个领域,先进的技术和工艺领跑国内外同行,满足不同客户对于色彩、规格、功能的不同需求。

“艺术挑战技术,技术成就未来。”金属印花是技术与艺术的完美融合,也是飞马加速器app孜孜不倦的追求和期望。在设计、加工、安装、售后各个环节,飞马加速器app人统筹管理,严格把控质量关,创新设计理念,完善服务内容,确保质量合格。

快速了解飞马加速器app,从企业宣传片开始

飞马加速器app新闻

PILOT NEWS以最简单的方法寻找最适合您的产品

30

2022-07生产记实 | 战高温!车间生产不服“暑”

这个夏天,飞马加速器app的生产车间里,辊涂生产线紧张有序运转,工人们有条不紊地操作,生产...

21

2020-02装配式建筑的“中国速度”

武汉疫情牵动我们每一个人的心,这是一场与时间赛跑的战役!为生命,争分夺秒!前几...

15

2019-11金属饰面保温一体板的方方面面

金属饰面保温一体板是指将EPS、XPS、聚氨酯、岩棉等保温材料与金属飞马加速器下载教程材在工...

05

2019-11消防演习︱重视安全,防患于未“燃”!

重视安全,防患于未“燃”,我们在行动!

04

2018-12飞马加速器app年产金属印花板、金属复合飞马加速器下载教程项目环境保护验收监测报告公示

飞马加速器教程成立于2016年11月11日,位于苏州市...

案例展示

PILOT CASE以最简单的方法寻找最适合您的产品